Spinoff investing is a fan favourite among small investors and hedge funds – but what are spin off companies, and what sort of returns could an investor achieve with the strategy?

It’s not a trivial question. Joel Greenblatt earned returns in the mid-40s (greater than a 40% CAGR) for two decades, partly focusing on spin-off companies.

So, what exactly are spin-off businesses, how have spin offs performed, and how can investors spot the best buys?

Table of Contents

Spin-off Businesses… What is a Spin-off Company?

A spin-off company is a new, independent business entity created when an organization “splits off” part of its existing business by separating a division, subsidiary, or unit from an existing parent company. We’re using split off loosely here to highlight when a parent company separates a venture to create a new, independent entity. An actual split off is a slightly different concept (but with many of the same implications for spin off company investors).

The event takes place as a stock dividend paid by a firm to its current shareholders. When a corporation divests itself of one or multiple divisions, it can either sell the division or spin off. If management chooses the spin off route, shareholders at the date of record receive stock in the newly created public company.

This process allows the spinoff to operate on its own, often with its own management, resources, and goals, while the parent company may retain some ownership or financial interest.

The term spin off companies generally refer to the actual corporation – not the stock, which is referred to as a spinoff stock. So don’t get the spin off company meaning mixed up with spin off stocks. They’re very closely related but slightly different.

Why Do Companies Opt for Spin-off Corporate Action?

What are the benefits of corporate spin-off?

Spinoffs typically occur when a corporation believes that separating a part of its business will unlock greater value, improve focus, or allow both entities to pursue distinct strategies more effectively.

For example, a large tech company might spin off its cloud computing division into a separate company to let it grow independently and attract specific investors. The parent company might distribute shares of the new company to its existing shareholders or sell them off, depending on the strategy. It’s a bit like a parent letting a grown-up child move out to start their own life — still connected, but free to thrive on their own terms.

Companies also spin off divisions if they see the division as a problem somehow – such as for ESG reasons as outlined below – or just want to unload debt.

Spin Off Company Examples - What is an Example of a Spin-Off Business?

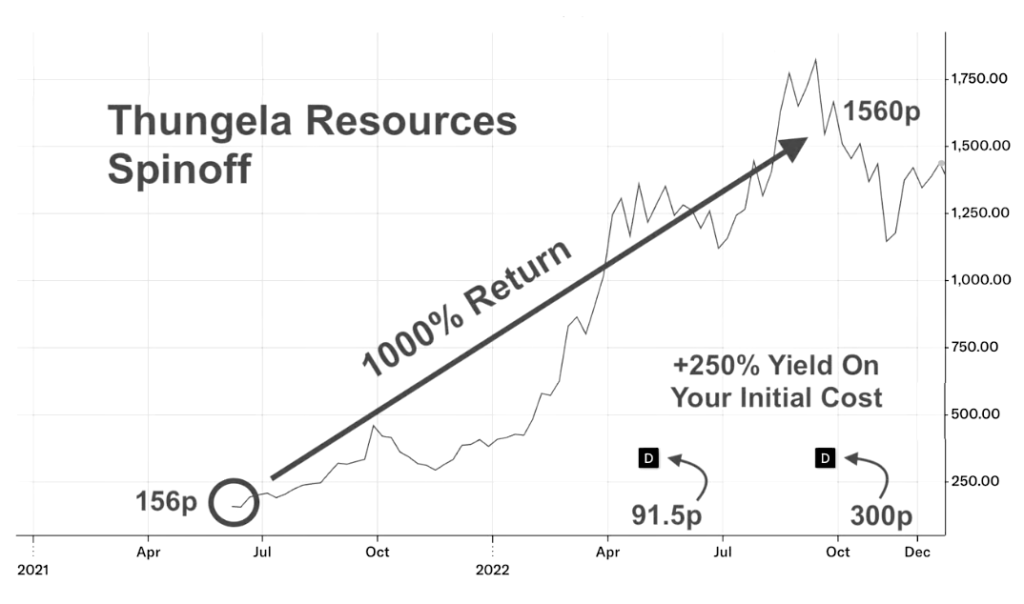

Multiple spin offs take place every year – they’re not exactly rare. One recent example of a spin off company that did fairly well is Thungela Resources.

Thungela is a coal producer that was spun off on June 7th, 2021 from Anglo American. Coal was taboo at the time in the West, and Anglo was keen to boost its ESG scores. Whenever a company is shedding an enterprise for non-economic reasons, investors should sit up and take notice.

Anyone paying attention (note: I wasn’t), though, could have seen that the company was going to make a huge amount of money for the next 12 months and that the price the company was to be spun out at was way too cheap - about $1.60 per share and a PE below 2x.

The result?

This spin-off stock ultimately returned 1540% over just 3.8 years (a CAGR of 92%) if you bought on first issue and held to the stock’s peak price. Granted, you can’t time the tops - pretty impossible to hit the sell button on the stock’s top tick, still you would have done well no matter what.

But, as good as Thungela was for investors, it wasn’t close to being the best spin-off company in history.

Best Spin Off Company Examples – Which Spin Off Companies Produced the Best Returns?

Ok, now that I’ve wet your appetite, let’s take a walk through financial history and look at the top spin off companies of all time.

Just to fantasize a bit, let’s pretend that we had $10,000 USD to invest in each and calculate what sort of Saudi Sheikh-like wealth we’d have earned if we invested.

Trinseo S.A. (TSE) - The Best Spin Off Company of All Time

Spun off in June 2010 from Dow Chemical, Trinseo hit the market at a price of $0.10 (split adjusted). By January 2018, the company’s stock had risen to $282 per share and the company had paid out $15 in dividends over the prior 7.5 years.

The total return from spin off to the start of 2018 was 296,900% (a CAGR of 259%). This would have turned your $10,000 into $29.69 million in just over 7 years.

Expedia Group, Inc. (EXPE) - A Great Spin Off From Spin Off Machine InterActiveCorp

IAC bought a controlling interest in IAC in 2001. After a few years owning the business, management had a change of heart and decided to spin off the company to shareholders.

Expedia hit the market in August 2005 at $0.38 per share (split adjusted). The dotcom bubble implosion was now a distant memory, and internet stocks had already begun recovering.

Over the next 16 years, Expedia excelled as a business. In November 2021, shares hit a whopping $290 per share, and the company had paid out $10 per share in dividends since being spun off.

A price escalation from $0.38 to $290 plus $10 in dividends is a total return of 78,950% (a CAGR of 256%). That’s enough to turn your $10,000 into $7.89 million US. No, not quite the returns Trinseo investors saw, but Expedia was still one of the most successful spin off companies in the USA. I doubt anybody would have made fun of you for underperforming.

Straight Path Communications (STRP) - A Straight Shot to the Spin Off Company Hall of Fame

Straight Path was a creation of IDT founder Howard Jonas, who bought wireless spectrum from a company out of bankruptcy during the dotcom bust. He later combined it with other telecom assets into Straight Path Communications and spun the company out in July 2013.

Straight Path hit the market at a price just under $5 per share and was a lacklustre performer for a couple of years. Soon, though, with 5G on the horizon, the telecom giants began to search for spectrum licenses and found Straight Path. A bidding war erupted, and the company was eventually bought for $184 per share.

The trip from $5 to $184 per share amounted to a 3,580% return, or about a 109% CAGR over 4 years. If you had invested $10,000 at spin off and held until the firm was acquired, you would have ended up with $3.58 million US. Not a bad take in just 4 years.

Now, these are the best of the best in terms of spin off company performance, so don’t make the mistake of thinking that each and every spin off company performs this well. There are plenty of flops, too. So, the question is really how can you identify potential winners beforehand?

How to Spot Successful Spin-Off Companies

Not every spin off you invest in will be successful. Remember that a spin off is just a corporate event that may create an opportunity for investors, but a spin off company will not automatically produce brilliant returns because it was created via spinoff.

When it comes to spotting successful spin off companies in advance, there are three approaches that you can take.

Approach #1: Find Bargains to Spot Successful Spin Off Investments In Advance

The first approach is probably the most reliable way to spot a winner among the pool of future spin off companies – focusing on bargains.

Every so often, noneconomic factors will come into play to produce a price that is far below what the newly created spin off company is worth. These could be ESG related, regulatory related, bear market, or due to management incentives. In the case of Thungela Resources, ESG was a major concern, and the stock was priced extremely low relative to what the company was expected to make going forward.

Even if a spin off company’s stock is fairly priced at the time of spin offs, sometimes selling pressure will create temporary dislocations in price, resulting in a significant bargain materializing. After a spin off, shareholders may want to sell their new holding, and this can create a pocket of weakness where the shares sink significantly over a 2 to 4 week period post-spin-off.

Obviously, buying an otherwise fine company at a bargain price can produce some great returns. The cheaper you can get shares for in the new spinoff, the better.

This approach to spin off companies will not produce enormous winners like the ones I wrote about above unless you can spot an enormous discount to fair value, as was the case with Thungela Resources.

Approach #2: Buy Great Companies at a Fair Price to Spot Likely Successful Spin Off Companies

Buffett loves to buy great businesses at a fair price – sadly, these businesses are usually trading at hefty multiples. But when a company "splits off" a section as a separate business, that new entity may have strong competitive advantages and a long growth runway ahead.

The key is to look at the firm’s operating performance prior to the spin off. You need to conduct as many checks as possible to tell whether the company is a strong performer, owns great brands, etc. You need some insight into why you think the firm is a great business.

While you won’t benefit from a value share price pop through this approach, like you will with our first approach, you do stand to make a significant amount of money if the spin off company proves to be a profitable growth company.

This was definitely the case when eBay spun off PayPal in 2015. Investors who saw that internet retail was projected to have great growth over the coming decades and recognized PayPal’s dominant market position & name recognition could have seen the likely path ahead. The result was a near 700% rise in just 6 years.

Approach #3: Focus on Spin-Off Companies from Successful Spin Off Machines

There are a few companies out there with management that have a strong preference for spinning off divisions. When spin offs seem to be an operational strategy used by a company on an ongoing basis, it’s time to sit up and pay attention.

A few of these firms have a great track record with their spin off companies, as well, watching their newly public creations climb to many hundreds of percent in the market.

If you can find one of these spin off machines, and you take the time to watch when a new business will be spun off, you may have an edge over other people who don’t understand the history and performance of the company’s past corporate actions.

One such company is IDT, led by Howard Jonas, who loves to buy tiny new upstarts, incubate them, and then spin them off to shareholders when the time is right. IDT’s record with spin offs is great, but there are other firms that do this, as well.

Bonus Approach: Find Spin Off Companies that Meet All of the Criteria to Increase your Odds of Success

While the last three approaches are great ways to identify future spin off winners, magic happens when you combine them. If you can find a great business being offered for a really cheap price by a company with a track record for successful spin offs, then it’s probably the best odds you can have when it comes to finding successful spin-off companies.

Spin-off Company List… Where Do You Find Spin Off Companies?

So, now that you’re convinced that investing in spin-off companies is where you want to place your money, where do you find a list of spin-offs?

You could piece a list of spin-offs together from various news sources, but there’s a better option. By far, the best move you could make is to sign up to a free service that will send you each and every spin-off announcement made. And a free service is best if you’re just starting out.

Luckily, I know of just a service.

Event Driven Daily’s Morning Brew newsletter sends subscribers all of the spin-offs it finds each and every month, along with a number of other special situations, all neatly packaged up into a monthly email. Click here to join the newsletter.

Alternatively (and not ideal, to be honest), you can check out a list of spin offs posted on sites that track them. For example, here’s our list of upcoming spinoffs. This list also includes recent spinoffs conducted by American publicly traded companies.

The downside of not subscribing to a service is that you have to keep checking in to see when a new spin off is listed – and that takes time and mental bandwidth. It’s much better to have experts just send you a stream of new spin offs that you might be interested in.

So, I recommend signing up for our free Morning Brew service because it’ll save you a lot of time and energy that you would otherwise have to spend finding these stocks.

Read Next: