When the market is overheated, many investors turn to event driven investing as a way to achieve alpha.

But they’re missing out, because the best returns possible are available to investors who habitually focus on that sweet combination of bargain hunting and event driven catalysts.

Just look at Greenblatt’s mid-40% two decade run… one of the best investment records in history. Have I got your attention?

In this article, I want to walk you through the concept of event driven investing and highlight a few different approaches that you can use to maximize your returns. Get your notepad out.

Table of Contents

What is an Event Driven Investing Strategy?

Event driven investment strategy is the focus on investing in unique situations where a stock or bond will be greatly impacted by an internal corporate decision or outside factors, both distinct from regular day to day business decisions.

The key differentiator here is that event driven strategies zero in on big events that are sure to have an impact on a particular stock or bond. Some folks call these catalysts for value realization, but whether a stock is trading below its intrinsic value is incidental to event driven strategy. The key, remember, is the big event… not discount to fair value.

But, as I mentioned above, smart investors combine the two, focusing on cheap companies where some big event will shake things up for the better. Yes, these tend to be equity oriented strategies involving investments, long or short.

Event-driven investing is a pretty broad area, but ultimately it’s an investment strategy that seeks to generate value through things like assessing cyclical industries to tell when one is going to swing into a bull market, special situations such as stock spin offs, index delistings or uplistings, or events such as a change in management focus from buying capital equipment to buying back their own cheap stock.

Why event-driven investing?

Event driven investing is simply another type of investing that aims to select investments that will move thanks to some big event – the advantage being that investors can readily spot the big event, and make an educated guess as to what will happen to a particular stock as a result. Unlike with value investing, investors don’t have to sit on a stock for years before a move takes place. They can spot a likely price change in advance and buy in anticipation of the move, before it happens.

I don’t know how many Japanese deep value firms that I’ve owned over the years have gone nowhere despite being ultra cheap. The missing ingredient was management's desire to correct the situation (or even make basic, prudent capital allocation decisions), or outside factors on the horizon that would move the company’s stock.

Focusing on event driven scenarios would prevent investors from sitting in purgatory forever, despite cheap valuations…

What is event driven finance?

Event-driven finance is essentially the same thing as event-driven investing – it refers to investment strategies that capitalize on price movements triggered by specific events affecting companies, industries, or markets.

What are event driven situations?

I already mentioned a few, but event driven situations basically encompass all special situations, plus cyclical investing, taking advantage of changes in the law, capital allocation policies, change in management, capitalizing on financial panics, etc. Let’s lay some out for you here:

Special Situations

- Spin offs - Where a company distributes shares of a subsidiary to their shareholders.

- Carve outs - Where a company forms a new subsidiary out of existing assets or operations.

- Tender offers - Where a company or 3rd party offers you cash for your shares.

- Recapitalizations - Where a company has a major share buyback or debt restructuring.

- Rights offers - Shareholders get the right to buy discounted stock.

- Merger arb - Capitalizing on the difference between the market price and the takeover offer.

- Activist pressure - Activists start pushing management around for the good of shareholders.

- Spawners - Companies that constantly start new businesses within the parent.

- Liquidations - Firms closing, selling everything, then distributing the funds to shareholders.

- Special dividends - Firms sending shareholders a large one-time dividend.

Market Based

- Index deletions - Where a firm gets kicked off of an index.

- Index inclusions - Where a firm gets listed on a more important index.

- Relistings - Where a firm lists its stock in a different jurisdiction.

- Price arbitrage - Capitalizing on the price difference for an asset between two markets.

- Capital flows - Anticipating which market money will move to and getting there first.

Economic / Legal

- Financial panics - Buying deep into the panic to get outstanding bargains.

- Industry turnarounds - A cyclical industry reaches its trough, and supply begins to tighten.

- Tariff impositions - When Trump puts a 1 million percent tariff on China.

- Economic policy changes - When governments incentivize economic activity in one area or disincentivize activity in another.

- Legal rulings - When a company gets compensation or permission to do something.

This is not an exhaustive list, but it should give you a great rundown of the sort of events that fall under event driven investment strategy.

What is an example of event-driven investing?

Ok, example… example… Here’s an example of event driven investing:

In 2020, the world was hit by the worst pandemic in at least 50 years. Even if you don’t agree that the virus was as bad as they say, the government response was one of the most restrictive ever, with lockdowns, business closures, transportation restrictions, etc.

In the midst of all of that, people were forced to stay home, locked in their houses or apartments for weeks. Now, maybe you can spend a day at your home and flip through some magazines, etc, but soon you get bored. Really bored. So, you begin looking for things to do.

Smart investors realized this and quickly picked up shares of companies that would benefit from lockdowns. Any product or service that would help people pass time in their own home while the virus raged would benefit from increased orders.

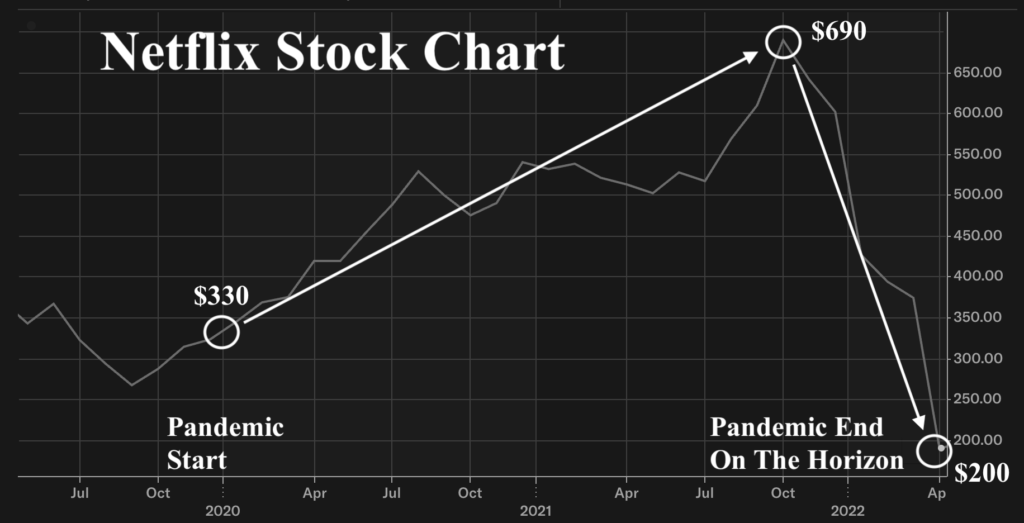

Netflix was one of those stocks. Investors bid up the company’s shares from $330 at the start of 2020 to $390 by October the following year. At that point, it was clear that the pandemic was going to end, so short sellers piled on the stock, sending it down to $200 per share the following year.

Why event-driven strategy?

Quite simply, investors stand to benefit from event-driven investing because event driven opportunities provide strong catalysts for price appreciation. A value investor, for example, who looks for event-driven scenarios as part of his value stock selection picks stocks that have a built in catalyst to lift the stock up to fair value, so they don’t have to sit with the position for years waiting for investors to bid the stock price up.

This has been a major issue with Japanese deep value stocks, for instance. Japanese deep value stocks tend to sit below fair value for years, sometimes decades. But, when the Tokyo Stock Exchange began to insist that companies get their stock prices up to at least book value, companies implemented programs to make that happen, and those stocks typically performed well vs their peers.

Event Driven Investing: The Nuts and Bolts

Event driven investors often start with news headlines. In order to capitalize on big events, you need to be aware of them, and they’re often hiding in plain sight. Headlines reveal upcoming special situations in individual companies, bankruptcies which may highlight an industry in a trough, upcoming index additions, and policy changes that will have big consequences on various industries.

Once an investor identifies a big event that they understand and have a strong conviction in, it’s time to dig into the firms that may take advantage of the event. This amounts to turning up stock lists and finding companies with significant exposure to the event, so the event has an impact on their fortunes or stock prices.

In the case of individual special situations, the investor just focuses on the company that’s going through the special situation. There’s no need to dig into stock lists and assess the exposure, because the special situation itself identifies the company that the investor has to research.

Let’s take a concrete scenario. You’re reading the Wall Street Journal and notice that Trump has just ended subsidies for clean power technologies. Thinking for a moment, you realize that a lot of marginal companies that rely on subsidies will suffer when they’re eliminated.

You understand solar the most, and know that there are a few solar suppliers and installers, as well as component manufacturers and suppliers in the US. You do a quick Google search for a list of firms in the industry and uncover a little known company that supplies larger companies with solar panels. It’s barely profitable, though, and it has a good amount of fixed costs. Checking the listed securities for the company, you notice that both call options and puts are listed. You decide to buy puts on the company that expire in 12 months.

Now, whether you make money from this trade or not really comes down to how well you understand the situation, the effect the subsidies have on the industry, the actual legislation eliminating the subsidies, and the impact that lower levels of business will have on the company you selected.

My own personal preference for event driven investing is to fund cheap stocks that can also benefit from a major event that’s on the horizon or has just been announced. Most people just call these catalysts, and I do as well. I start with a list of stocks that are cheap, and then read through the press releases and conference call transcripts to find events or initiatives by management that I think have a good chance of listing the stock.

But, I also look at beaten down industries that seem to be recovering after years of decline, and try to purchase stocks in those industries that should benefit considerably from the cyclical upturn. Here, the big event is the fact that supply has tightened up – perhaps through firms exiting the market or bankruptcies – and when supply tightens and demand keeps growing, profits follow.

What is the event driven method of stock market trading?

Event driven trading refers to the actual buying and selling of securities that will be affected by some special situation or big event. It includes the buying or selling stock, bonds, or options, and other esoteric instruments that few people understand.

When most people refer to trading, they’re talking about betting on the direction of a stock based on some event, and this is definitely a form of event driven trading. But it also includes investors who go long or short a security for a longer period of time. You don’t have to close out your position before the market closes or watch candlesticks and a trading monitor to trade around events. You just need to buy or sell some security in an attempt to capitalize on an event.

Event Driven Investing Examples: Real Moves That Paid Off

So far, we’ve talked about what event driven investing is, various event driven investment strategies, as well as the nuts and bolts of identifying attractive event driven stocks. Now I want to highlight two great event driven investments that you could have capitalized on over the past decade.

By the end of this section, you should have a pretty good idea of the returns on offer and the sorts of events that you can spot with a little footwork.

Louisiana Pacific’s new CEO creates an outstanding event driven investment opportunity

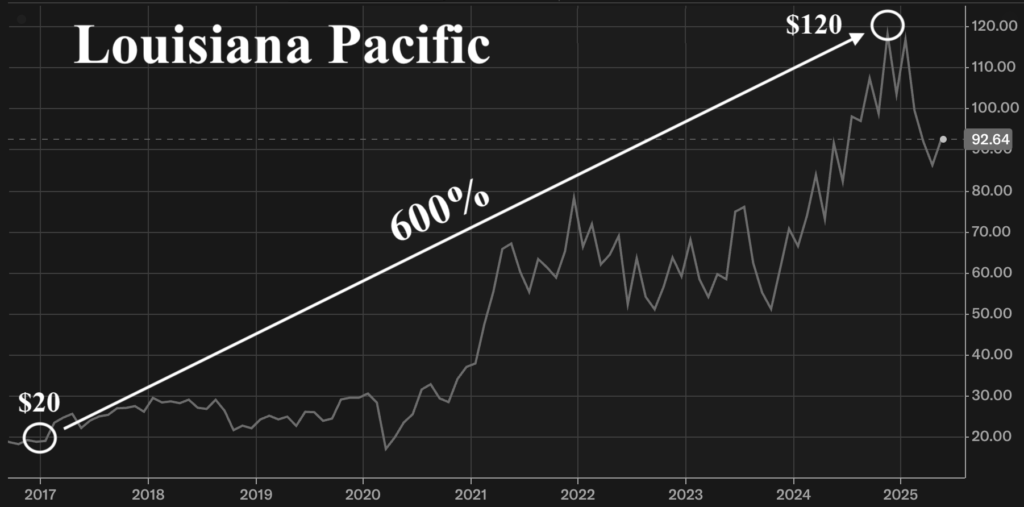

Louisiana Pacific (NYSE: LPX) was a commodity board producer in the housing industry. In 2017, Brad Southern was appointed to the CEO position. This was a small change, but sometimes a new CEO sparks major business improvements that take a company in a completely different direction.

Luckily for LPX shareholders, Southern was the second sort. He soon announced a major strategic shift for the company, moving from a commodity board producer to a building solutions company. He aimed to produce proprietary building technology that outperformed other offerings and commanded a price premium. In theory, this would give the firm pricing power.

Southern followed with a couple strategic acquisitions, redeploying capital into higher ROI businesses, and optimizing the company’s cost structure. He also directed LPX to begin aggressively repurchasing stock, reducing the share count by a whopping 50% over 5 years.

All of these moves produced a massive move in the stock price, rising from $20 to $120 in 8 years.

Anybody could have seen the changes that were taking place at LPX. You just needed to be awake to what was happening. And, you didn’t have to rush to get in, either. The stock remained flat until near the end of 2020, roughly 3 years after the CEO change and change in strategic direction.

Apes attack GameStop short sellers creating an event driven investment windfall

Have you ever seen the Planet of the Apes movies? There’s a scene in one of the movies where one of the apes is talking to another, explaining the idea behind organizing individuals into a formidable force to defeat the humans.

A similar thing happened on Reddit in 2020.

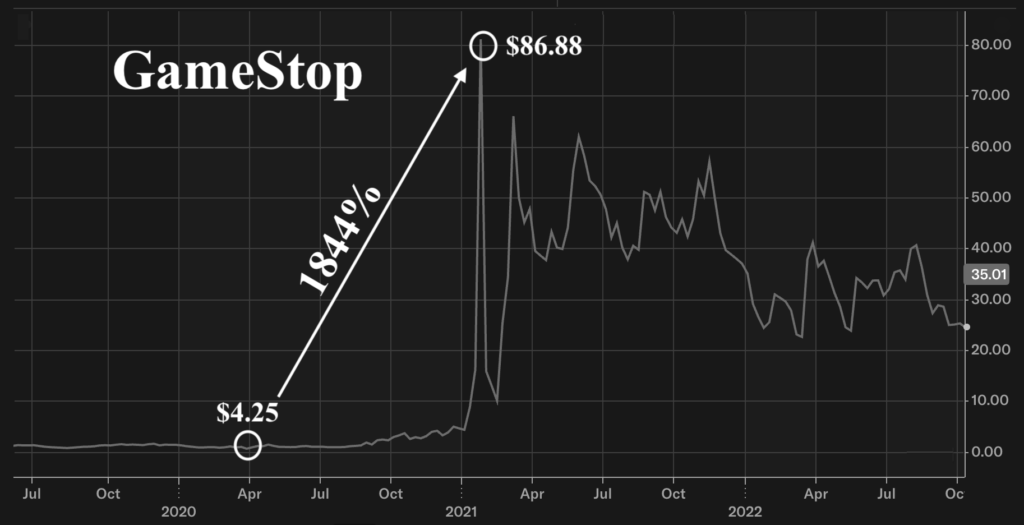

GameStop was a struggling video game and electronics retailer operating in the USA. It was once a pretty successful company, but the move to digital downloads hit their business, decreasing foot traffic and eroding their bottom line.

Seeing the opportunity, hedge funds such as Melvin Capital and Citron Research began piling on the company by shorting the stock. The bet was that GameStop was going out of business, and the stock would continue to decline on the way to zero. The short interest in the stock climbed to over 100% of the float.

But, members of a Reddit group named WallStreetBets noticed the extreme short interests levels, and began to organize. Influential figures such as Keith Gill (aka “Roaring Kitty” or “DeepFuckingValue”) posted detailed analyses on Reddit and X, highlighting GameStop’s undervaluation and the potential to trigger a short squeeze by buying shares and call options. Then, Ryan Cohen, co-founder of Chewy, joined GameStop’s board in January 2021, boosting optimism about a potential turnaround through e-commerce.

Retail traders, using platforms like Robinhood, began aggressively buying GME shares and call options, driving up the stock price. The coordinated buying was fueled by a mix of financial strategy, anti-Wall Street sentiment, and a desire to “stick it to the hedge funds.” Social media platforms, especially Reddit and X, amplified the movement with memes, YOLO (You Only Live Once) posts, and calls to “hold the line.”

In early January 2021, GME stock was trading around $17-$20 ($4.25 to $5 split adjusted). As the retail crowd began to scoop up shares, the price began to climb.

With mounting losses as their shorts went against them, the hedge funds were forced to cover their short bets, going into the open market to buy shares. This just pushed up the share price further. By January 27, 2021, GameStop shares surged to a peak of $347.51 ($86.88 split adjusted) during regular trading and an intraday high of $483 ($120.75 split adjusted) on January 28, a gain of over 1,700% in weeks.

Event Driven Investing: Tying It All Together

Event driven investing is a very smart approach for investors to take when picking stocks. It does not matter if you are a growth investor, a value investor, a GARP investor, or whatever. Buying into an event driven opportunity just increases the chance that your pick will work out.

And, as we’ve seen above, the returns on offer are often LARGE.

But a question remains: How does an investor find opportunities like these?

If you have a subscription to The Wall Street Journal or The Financial Times, then you can scan the headlines to find events to take advantage of. This requires you to be active in scanning for opportunities, and obviously takes some time to uncover them.

A far better approach is to sign up for a service such as Event Driven Daily’s Morning Brew Newsletter, that will send you deals they uncover.

Each and every month, we scan the internet for all the announced special situations and then package them up into a tidy email and send it to subscribers, for free.

This saves our free subscribers dozens of hours each month scanning for special situations and event driven opportunities themselves. Enter your email address in the box below to get on our list because it will give you a huge leg up over the competition.

Read Next: