Given the mountain of blogs out there, how are investors supposed to sort the good special situations investment analysis from the bad? Not everyone wants to invest in indexes, and it pays to get a competent second opinion on a stock you're thinking about.

So, how do you do it?

Individual investors have a terrible record as a group. From 1994 until 2014, a 20 year stretch, investors were only able to nail down a 2.5% CAGR on their investments. This was well below the 30 Year US Treasury's 8% return, gold's near 6% return, or the world market's 7.5% compound annual return.

Given this problem and our increasingly busy lives, an increasing number of investors are seeking out investment analysis on blogs or investment platforms. This comes with an enormous amount of risk, however, as writers may not have the skill or experience you think they do.

So, how is a private investor just trying to save for retirement supposed to tell good investment analysis from bad investment analysis?

Look At Investment Analysis Within The Context Of A Larger Investment Strategy

It's critically important to view investment analysis within the context of a particular strategy; and, understanding your chosen strategy is key to understanding how to look at a piece of analysis.

Are you a contemporary Buffett "growth" investor or an old school Ben Graham value investor? Are you looking at special situations or plain vanilla cheap value stocks? The overall strategy that you select to grow your money over the long term really matters, and it will shape what you look for in a solid piece of investment analysis.

Take a typical Buffett Investor, for example. That investor will sit in cash sifting through a mountain of stocks to find a great company with a solid competitive advantage and rapid growth prospects. He might only hold 3 to 6 outstanding companies, and buy a single company every couple of years.

The sort of investment analysis a contemporary Buffett investor needs is quite different from the sort of analysis a mechanical value investor needs. A Buffett investor would require a deep qualitative look into many areas of the business, the industry, management and the competitive landscape to tell whether the company is a good buy or not. For example, he would have to look at how the company performed compared to others in the same industry over long spans of time to gage whether the company had an ability to out-compete its competitors. If it turned out that it could, he'd have to figure out why the company had an advantage and estimate its durability. Later, he would have to assess the company's key competitive strengths to make sure they remained in place so that his company could keep growing.

A mechanical value investor, on the other hand, would require a much more superficial quantitative analysis to assess whether the company was cheap and, possibly, financially strong. Graham characterized this sort of selection when late in life he said:

“[I recommend] a highly simplified [strategy] that applies a single criteria or perhaps two criteria to the price [of a stock] to assure that full value is present and that relies for its results on the performance of the portfolio as a whole--i.e., on the group results--rather than on the expectations for individual issues.”

A special situation investor, by contrast, really doesn't have to look at the qualitative aspects of the company or classic assessments of value. He'd have to look at whatever special event is around the corner that he expects would give the stock a bump up in price. The profit is often spelled out in math inherent in the the situation itself.

You have to have decided on an investment strategy before you can begin to assess whether a piece of investment analysis is good or not; and, an author has to spell out how the stocks should fit into an overall portfolio. Once you nail down your strategy, you'll have a good idea of what sort of analysis you need to assess a stock.

An Investment Analysis Is Only As Good As The Strategy It's Based On

The last section laid out the reason why you have to look at an analysis within the context of a particular strategy. On a similar note, good investment analysis is rooted in a good investment strategy. This should be obvious but it's often overlooked. If your idea of good investment analysis is analysis that highlights high performance stocks, adopting a high performance strategy first is key.

I've been helping small investors earn exceptional returns since 2010, and in my experience, investors are their own worst enemy. One of the chief errors is failing to adopt a great investment strategy. Instead, investors select strategies based on investment fads, or gut feelings, rather than seeking out the best strategies to use.

If you've selected a strategy that typically compounds at an average of 10% per year, and you seek out investment analyses to select stocks for your strategy, don't expect the average stock recommendation to earn much more than 10% per year. While it's possible, it's certainly not likely.

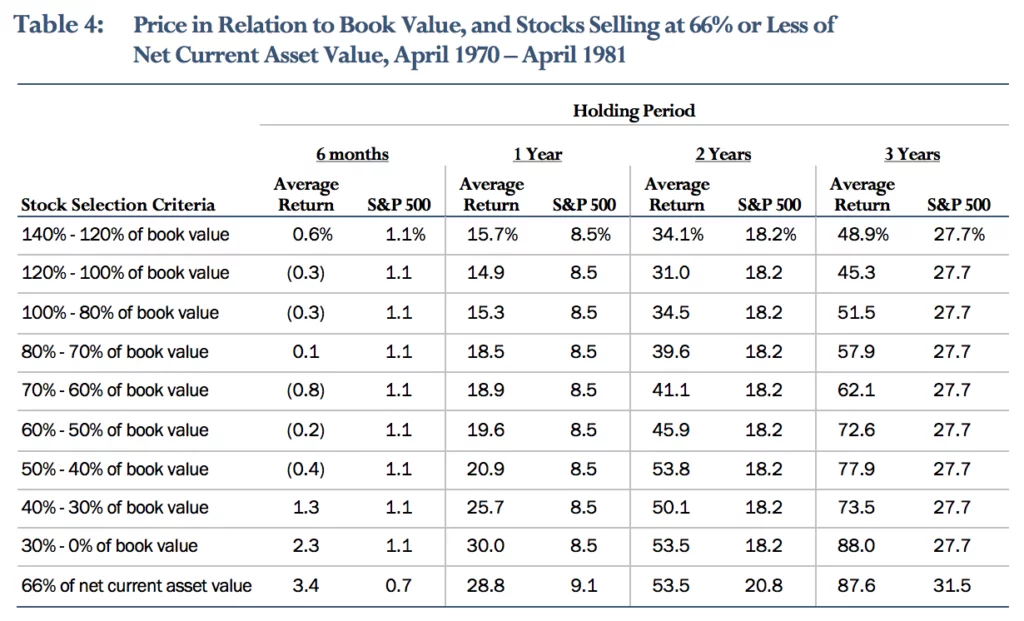

A great investment strategy is one that's proven to achieve the objectives that you want. In my case, I want the strategy that I follow to earn long term returns of 25% or more and to reduce risk (ie. maximum drawdowns and permanent losses), as well. Rather than just hope for these returns, I'm following two excellent investment strategies: cigar butts and special situations. Cigar butts, such as net nets, have been backtested since at least the 1930s and produce outstanding returns - even today. It's one of the best investment strategies that small investors can adopt.

Special situation stocks often have a return profile that's built into the actual situation, whether you're looking at a spin off arb, risk arb, or recapitalization. Take a spin off arbitrage, for example, where a parent is spinning off the rest of its subsidiary. With a piece of the spinco already trading in the market, you can short it and by the parent to collect any inefficiencies in the pricing of the parent. That inefficiency, less fees and taxes, is literally the profit you can expect to make from the event.

If I want to find high performance stocks that also reduce risk, I have to do so within the framework of these strategies. A good investment analysis then, for me, will be an analysis that focuses on either of these two strategies.

Once again, it really matters that the strategy that you follow is proven. I prefer strategies that have been studies by academics or in industry white papers, or are near mathematical certainties. But, more than that, I also demand that any strategy I adopt be proven through actual use in practice. It's one thing to cherry pick data until you find something interesting, but quite another to be able to use your chosen strategy in practice. Despite the promising numbers, investors may not be able to use strategies such as relative price strength or strategies focused on thinly traded stocks.

A Solid Investment Analysis Employs A Well-Crafted Checklist

When was the last time you came home from the supermarket only to find that you forgot to pick up a few things?

It's understandable. Supermarkets are big places with thousands of products. There are flashing signs, sales, people talking or dressed in strange clothes, spills on the floor, free samples, and a million other distractions. It's only natural to expect our attention to go astray when we enter that environment.

Come to think of it, that description sounds a lot like the stock market. With so many distractions, is it any wonder that investors forget to check a couple ratios or the notes to the financial statements in some quarterly statement?

These days, solid investors use well-crafted checklists to help guide their research. A checklist, or scorecard, is a shopping list of items that an investor runs through when analyzing a stock. The purpose is to keep the investor focused so that he doesn't forget a detail thought to be important to an investment's success. By using a checklist, an investor can conduct a much more thorough or well reasoned assessment despite the ocean of data in front of him.

It's worth noting that all sorts of professions have adopted a checklist to boost performance. Airline pilots, for example, run through a checklist at the start of each flight - even before turning the engines on. Running through these lists allow for a much safer flight. Doctors employ them as well, in some cases, and researchers have found a dramatic reduction in costly errors.

In the investing world, a number of professional investors have adopted checklists - most famously Mohnish Pabrai, author of Dhandho Investor - and mechanical value investors rely on them more than anyone.

A solid checklist requires some serious thought. You don't just throw a bunch of criteria on a sheet of paper and then run through it. Each criterion has to be well thought out and all criteria have to work together to arrive at a solid decision. Sometimes you'll find that an investment characteristic that you thought added significant value actually leads to lower returns or higher risk - so backtesting is extremely important.

But, given how effective checklists are for reducing errors and improving outcomes, I would not trust an analysis today that was not based on a well thought out scorecard. Neither should you.

A Solid Investment Analysis Is Not Based On Future Projections

The Buffett growth crowd will disagree, but I'm firmly in the Graham camp when it comes to predicting the future.

When Graham was in the middle of his career, he said that the future is something to be guarded against, emphasizing the need for protection over projection. He was right - mostly. If there's one thing that we discover again and again, it's that our expectations about the future are usually wrong. The future has a way of surprising us, for better or worse. Think about the last time you got into a car accident, or expected a raise or new job that didn't pan out.

Of course, nothing wrong with betting on situations that you assess to have a great outlook if there is a significant margin of safety based on actual value present today.

These are big and obvious examples, but numerous smaller events surprise us on a daily basis - all errors in accurately predicting the future. When was the last time your kid jumped out at you from behind a door? Did it surprise you? That's a failure to accurately predict the future. Ever spill your coffee? Ever get caught in a line up you didn't expect? You get the idea…

When it comes to investing, everybody is trying to make predictions. Most investors want to buy companies that are growing earnings, boosting their dividend, etc. Companies with obvious prospects for growth are often bid up to ridiculous prices, for example, in anticipation of the growth. In fact, prices can be bid up to a level that fully reflects future growth… so there's no advantage left for investors if the firm does grow. Reflecting our fallibility when it comes to prediction, often growth does materialize and investors get slaughtered by the falling stock.

Investors that pay a high price for great expectations often suffer devastating losses. As a result, their long term performance really takes a hit. This is why deep value strategies habitually outperform buy-and-hold moat investors. Since the future is uncertain, I prefer to assess a company based on what the actual facts are right now, today. That means a solid look at the company's financial position and its underlying value.

I often stumble across cigar butt or special situation stocks that are offered up for fire sale prices. I often buy stocks that are trading for less than half of their intrinsic value. You almost never find great companies trading at these prices. The stocks I buy almost always have problems, and investors are projecting these problems forward indefinitely - another error in future projection. Ironically, this pessimism sets up outstanding future returns.

Notice the difference here. Investors either push prices way up or way down based on future expectations. I'm merely accepting the fact that people are terrible intuitive forecasters, and looking at the company's underlying value & financial position right now, today, instead. This makes investing MUCH easier… and much more profitable.

I often find investment analysis by authors who do nothing but try to predict what the company will do next month, next quarter, or next year …and spend next to no time looking at the company's current stats. Avoid these sort of investment analyses at all costs.

Ironically, most Wall Street analysts - with their MBAs and CFAs - pump out this kind of research, as well. Yet professionals underperform the market on average by 1 or 2% per year. Since we know how hard it is to predict the future, why try to compete with them?

A Solid Investment Analysis Digs Into A Company With The Right Amount of Depth

Aristotle once said that it's the mark of an educated mind to look into a subject with only as much detail as the subject allows.

This brilliant insight from over 2000 years ago should help you put investment analysis into context today. Remember back earlier in the article to our discussion on looking at an investment analysis within the context of your chosen strategy? The context specifies the amount of detail that an analyst should go into when assessing a stock for purchase.

Part of the reason is because underlying principles change from strategy to strategy. Some strategies focus on trying to pick a few exceptional stocks and holding them for the long term. Buffett's current investment strategy falls into this category. Since there are only a few truly exceptional stocks capable of long term growth, this strategy favors strong concentration and, therefore, demands in depth research.

Other growth investors may have less conviction that their companies will continue to grow because they lack a moat. Instead, they aim for rapid earnings growth over shorter periods of time before exiting the investment. Because of this, these sort of growth investors may employ wider diversification and demand slightly less in depth research.

Deep value strategies often rely on the historic statistical performance of groups of companies characterized by one or two distinguishing features - the same description Graham gave in his quote above. For example, low price to book value stocks may have historically produced a 14% return. A deep value investor would try to capture this return by buying a diversified basket of low price to book value stocks. Deep analysis is not required - though wide diversification is - because investors are essentially trying to create an "index" of stocks with a specific characteristic.

Special situation analysis often comes down to basic mathematics. So, a solid analysis of a special situation investment will come down to correctly assessing the likely payout value and payout date, then any risks that could materialize to derail the special event. At other times, a special situation investor will spot an event that offers up some outstanding bargain that's overlooked by the market. In these situations, having a good sense of how to value the security, and having a clear assessment of the risks involved in the investment, are fundamental to good analysis.

This big picture look at solid investment analysis should provide the foundations for how you assess a piece of research. Stock analysis is quite diverse in its application but I consider our factors above basic requirements for a good investment analysis. Now, to click here to learn more about valuing a business.

Enter your email below to get the latest special situation stocks delivered straight to your inbox, because there are always outstanding deals to be found.